Present value of lease payments formula

Monthly Lease payment 2208 119 47. Enter liability balance formula.

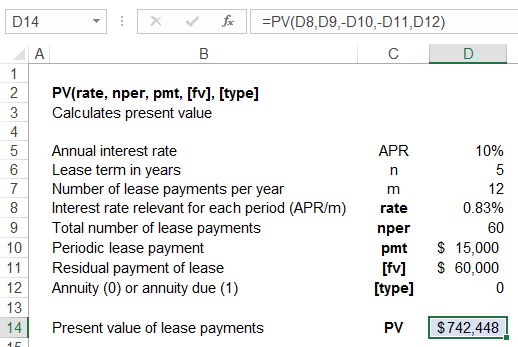

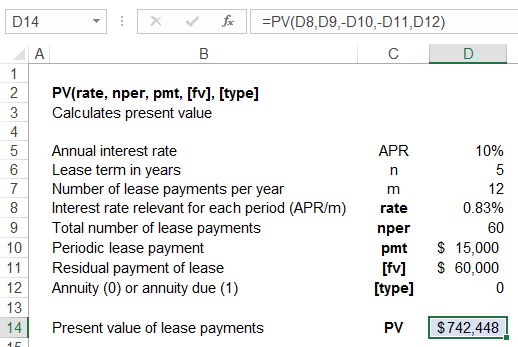

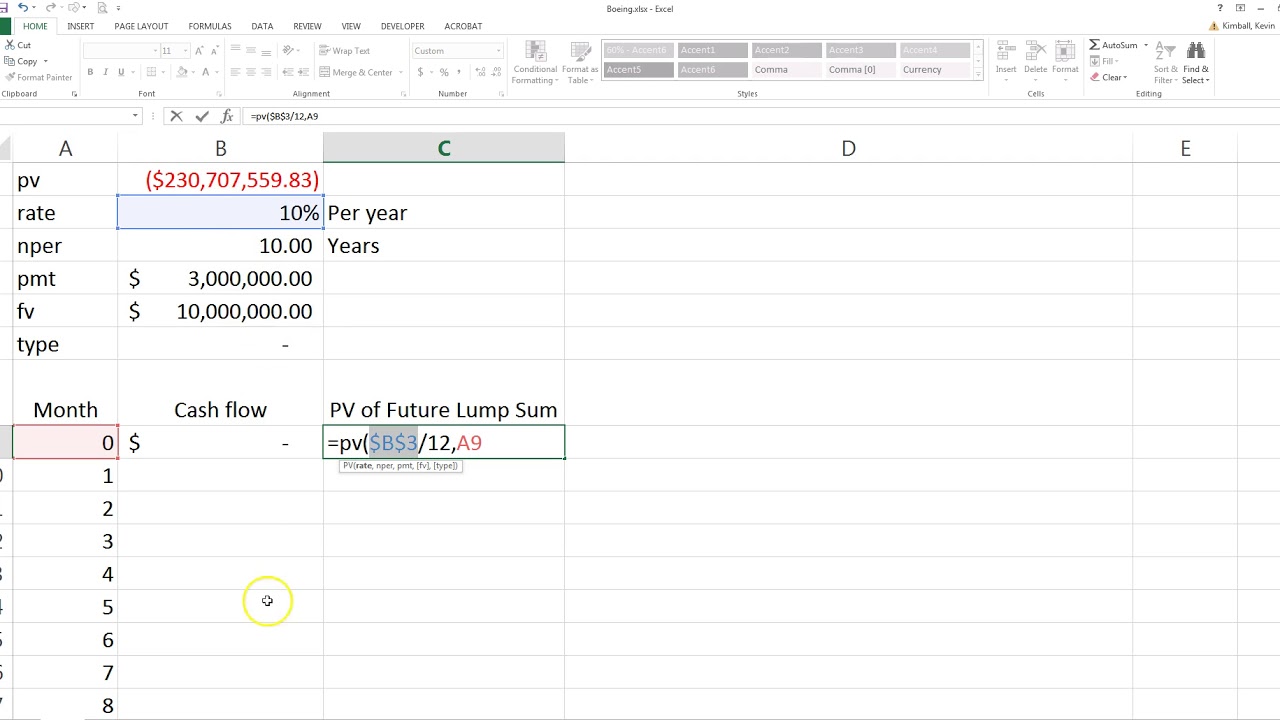

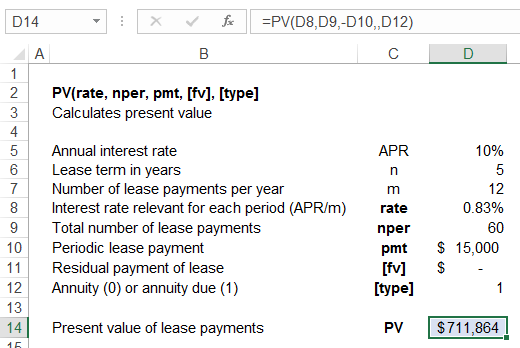

Calculating Present Value In Excel Function Examples

PV of Lease MLP URV1 rn.

. Refer below for seven. EMI P r 1 rn 1 rn 1 where P Loan amount r interest rate ntenure in number of months. Outlined below are the components of Excels present value formula and how each input can be affected in the application of the new lease standard.

Here are the steps to calculate. PV SUMP 1 r n RV 1 r n Where PV Present Value P Annual Lease Payments r Interest Rate n Number of Years in the Lease Term RV Residual Value. Lease Payment in Income Statement.

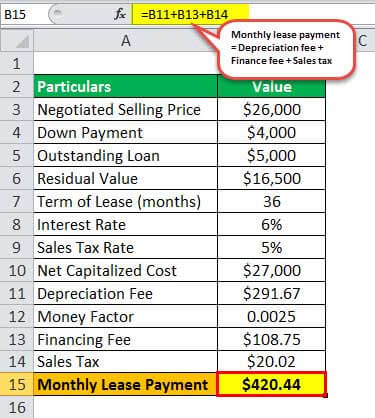

It is most commonly associated with car leasing. MLP Minimum lease. Monthly Lease payment 2374.

Present Value of a Lease. Fill remaining liability balance. Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease.

Perform What-If Analysis on liability balance. Enter Present Value into cell A4 and then enter the PV formula in B4 PV rate. This calculation is the opening balance of the assets right of use asset divided by total days in the lease.

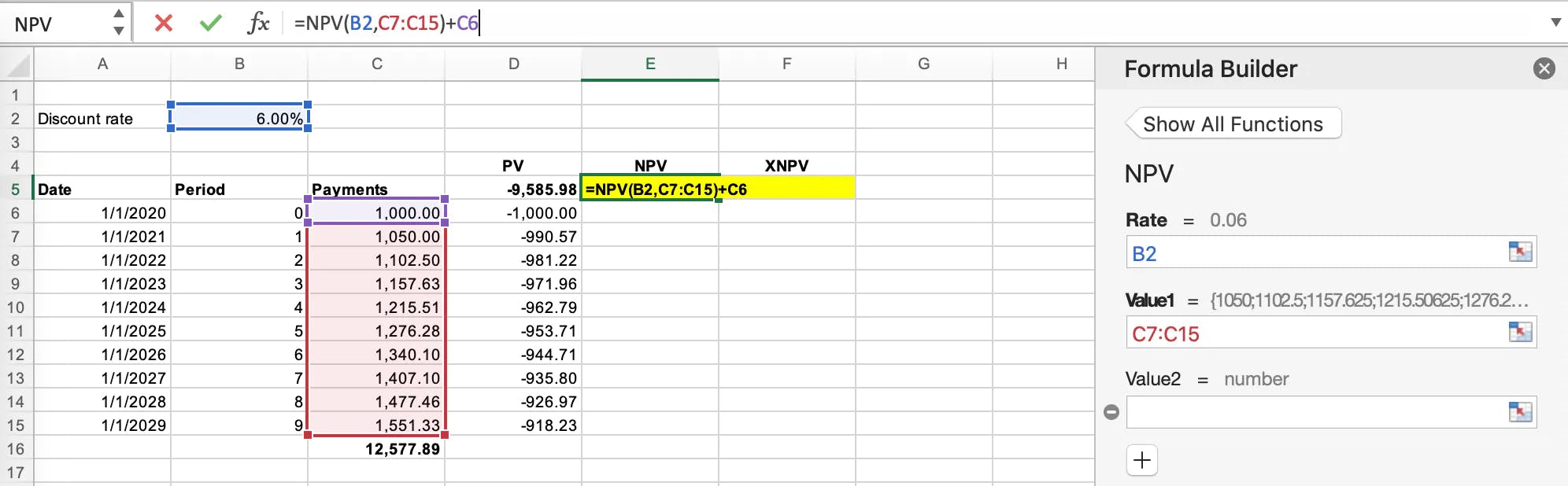

Best answer by Janith Bandara Hi Carlo Palma Usually the formula is 1 1rnp Lease payment for an example if the schedule consists of 12 months the PV. The built-in function PV can easily calculate the present value with the given information. Set liability balance value to 0 with goal seek.

For multiple payments we assume periodic fixed payments and a fixed interest rate. This then the daily depreciation rate. The mathematical formula to calculate EMI is.

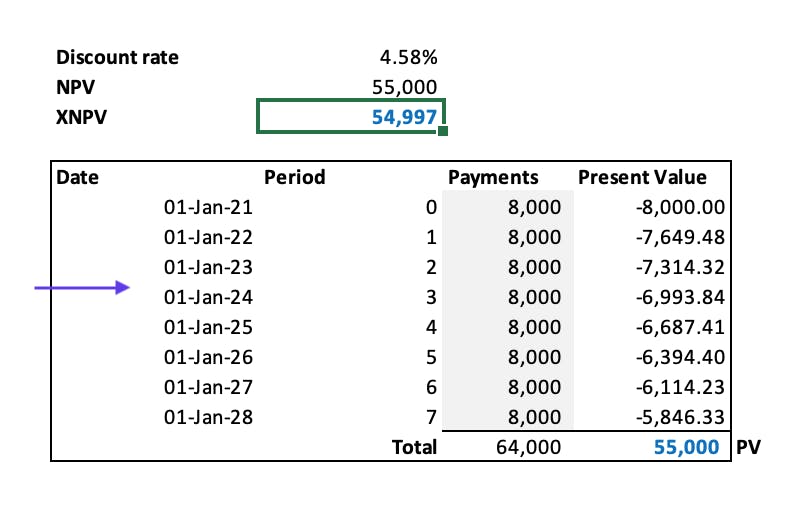

NPV is based on future. The principle of value additivity states that the present value lease amount is equal to the present value of the monthly payments an annuity plus the present value of the residual. PV Present Value CF Future Cash Flow r Discount Rate t Number of Years Inputs In order to calculate the present value of lease payments judgements will need to be.

The formula of present value of minimum lease payments looks like this. It holds because the periodicity of the lease payments is typically. Once the present value of total lease.

A lease liability is required to be calculated for both ASC 842 IFRS 16. The lease liability is the present value of the known future lease payments at a point in time. PV SUMP1r n RV1r n Where PV Present Value.

P Annual Lease Payments. Alternatively the function can also be used to calculate the present value of a single. Monthly Lease payment Depreciation Cost Finance Cost Sales Tax.

Calculating the present value of minimum lease payments can also be achieved using an annuity formula.

How To Calculate Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments Excel Occupier

Compute The Present Value Of Minimum Future Lease Payments Youtube

Calculating Present Value In Excel Function Examples

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate A Lease Payment Double Entry Bookkeeping

How To Calculate The Discount Rate Implicit In The Lease

Using Pv Function In Excel To Calculate Present Value

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments Excel Occupier

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

How To Calculate The Present Value Of Future Lease Payments

Lease Payment Formula Example Calculate Monthly Lease Payment

Lease Payment Formula Example Calculate Monthly Lease Payment